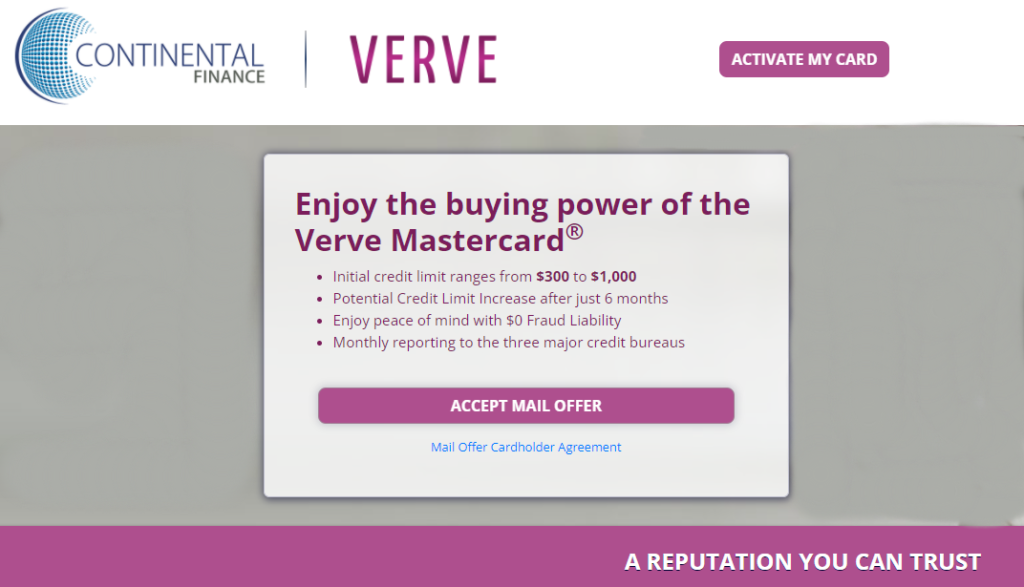

The YourVerveCard site is your gateway to apply and activate your new Verve credit card. It has a simple interface that is easy to navigate. Keep reading to learn how to accept your reservation, apply for prequalification, activate your card up receipt and what to expect throughout the process of applying for and being accepted as a new card holder. If you’re looking for VerveCardInfo this article is for you!

So read on below for our complete guide to all things related to your new Verve card so you can be sure you are enjoying all of the benefits the Verve credit card has to offer you.

Verve Credit Card: Apply, Login & Activate Your Verve Card at VerveCardInfo.com

How to Activate Your Verve Credit Card at VerveCardInfo.com

To activate your card just visit vervecardinfo.com and click “Activate My Card” button in the menu bar. On the next page follow the steps to activate your Verve Card.

How to Login to my Verve Credit Card Account?

Once you’ve been approved for your Verve Card and received it in the mail you can login at VerveCardInfo.com. There you can monitor all account activity, check your card balance, make payments, request a credit line increase, contact Verve Mastercard support and much more. The VerveCardInfo.com login site is specifically reserved for cardholders and it not the place for those looking to become new cardholders.

Online Application for YourVerveCard with a Reservation Number

If you’re already pre-qualified for a Verve Master card you should receive a letter in the mail. Get your letter and start by visiting YourVerveCard.com and entering your reservation number and your social security number. By entering your reservation code the system can confirm your reservation and let you apply for a Verve charge card.

What If I Don’t Have Your Reservation Number?

If you lost your reservation number, don’t worry. After the sentence “Don’t have your Reservation Number?” you’ll find a hyperlink that says “Search Now.” Click that button and enter the following information to look up yourvervecard.com reservation

- Your last name

- Your zip code, and

- The last four digits of your social security number

If your reservation is active, it’ll take you through the rest of the application process step-by-step.

What if My Reservation Number Isn’t Working?

If your reservation number isn’t working it has probably expired. If you no longer have an active reservation for any other reason, you’ll need to fill out a quick pre-qualification form. To pre-qualify, you’ll need to submit a short Verve Credit card application. Follow the steps outlined above as if you’re searching for your reservation number.

Then, it will give you the message, “We’re not showing a current reservation in your name. Click below to see if you pre-qualify.”

Then just click the button that says “Pre-Qualification.” The button will redirect you to another site.

How to Pre-Qualify for YourVerveCard

To pre-qualify for a YourVerve card, you’ll need to provide quite a bit of information, including

- Your full name

- Your address

- Your phone number

- How much money you make monthly

- Your primary source of income

- Your birthdate, and

- Your social security number

While this might seem like a lot, it’s normal for credit lines to require in-depth information. They need this information to confirm your identity, protect you from credit fraud and ensure you have the income to support being a Verve Mastercard cardholder.

Getting Your New Verve Credit Line

They may ask you a series of questions about your income, work status, and U.S. citizenship after moving past the initial stages. Then, they’ll run a credit check to see if you qualify. You may receive a tentative answer immediately, based on the information you provided. The final answer will likely come in the mail in a few weeks.

If you receive an accepted line of credit, you should get your card and letter relatively quickly. If you didn’t, your letter will explain why you didn’t qualify.

Features & Benefits of Being a Verve Credit Card Holder

Made for Those with poor credit scores

The very card comes with a low initial credit limit and is specifically for those with average to poor credit. The idea is this card can help you rebuild and improve your credit if you make your payments on-time and don’t go over your credit limit.

Free Credit Score

You can check our credit score with the Verve Card for free inside your VerveCardInfo account and it is updated each month. This allows you to track your credit score as it increases and you can build momentum by continuing to manage your credit resonsibily.

Zero Liability for Fraudulent Purchases

If you lose your card or your card number is stolen no need to worry since the Verve Credit card comes with $0 liability for unauthorized purchases.

Verve Card Customer Service

If you need to contact the support department for your Verve Mastercard Card you can login to your Verve card account and submit an online request or you can call for immediate support at 1-866-449-4514

Final Thoughts on the Verve Card

YourVerveCard.com is a simple, clean interface that lets you quickly apply for your new credit line. You can use your prequalification information or apply for pre-qualification on the spot. Everything you need to apply is readily accessible so you can have the credit you need in a matter of minutes. Once you are a proud Verve charge card holder just visit VerveCardInfo.com to manage your account and enjoy all the benefits of your new Verve Mastercard.